Be honest now. What do you do with all those booklets you get that describe your employee benefits in detail? I suspect most of us add them to our “reading pile,” along with the latest magazines or inserts from the electric bill. Of course, you may no longer do this physically, since these days a lot of information about employee benefits comes to us electronically, perhaps on our employer’s internal website. Either way, the result is largely the same—you probably add the link to your online viewing pile with the latest cat-playing-piano video. Here at BLS, we actually read those documents and websites on employee benefits for you and use them to help everyone understand the benefits coverage of American workers.

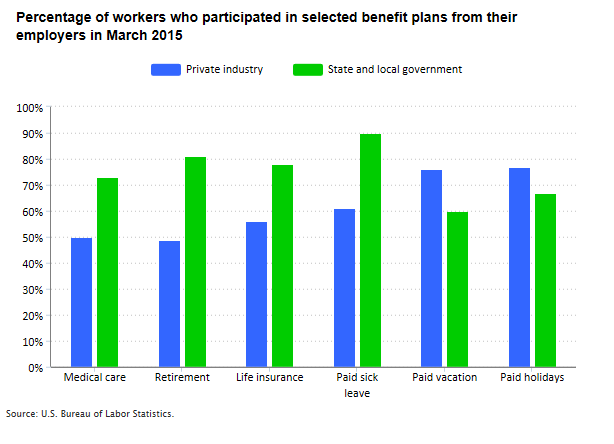

As a result, last week BLS released data on the percentage of workers covered by employee benefits in 2015. This report is part of an annual series about benefits. The newest data show that 50 percent of private industry workers participated in a medical care benefit plan through their work, 49 percent had a retirement plan, and 61 percent had paid sick leave available.

A strength of these data is the detail about the workplaces that provide benefits and the workers who receive them. For example, paid sick leave benefits vary based on the number of workers at the employer’s location: 80 percent of private industry workers had paid sick leave in the largest establishments (500 workers or more), while 49 percent had paid sick leave in the smallest establishments (fewer than 50 workers). Looking at retirement benefits, 12 percent of private industry workers in the group with the lowest 10 percent of wages ($9.00 or less per hour) participated in a retirement plan through their employer. That compares with 78 percent of workers in the group with the highest 10 percent of wages ($43.27 or more per hour).

A recent edition of The Economics Daily features visualizations about how retirement and medical care benefits vary by occupation.

The new report also shows how the cost of medical care benefits is divided between employee and employer. This year, employees in private industry paid, on average, 22 percent of the cost for single coverage and 32 percent of the cost for family coverage; employers picked up the remaining cost. Later this year, more detail will be available on the cost that employees and employers paid for these benefits.

Back to those plan booklets. At BLS, we cull through the details to report on plan features and the value of benefits. Earlier this year BLS released those details for 2014 health and retirement plans in private industry. Among the findings are that one in three workers covered by a medical care plan was in a high-deductible plan, with a median individual deductible of $2,000 per year. Among 401(k) plans, 41 percent of participants were in plans that automatically enroll new employees into the plan, often with a default contribution of 3 percent of earnings. Plan booklets also showed that 401(k) plans commonly match 50 percent of the first 6 percent of earnings that workers contribute.

Employee benefits are a key part of compensation—just over 30 percent, on average. Benefits protect employees and families in the face of medical, financial, and other concerns. So, even though reading the details of those plans may not be high on your to-do list, rest assured that BLS is keeping on top of these issues for you and reporting the details throughout the year.

United States Department of Labor

United States Department of Labor